Company Stock Plans

Understanding your equity incentive plan is crucial to maximizing your benefits. Our experts guide you through how these plans can enhance your resources in retirement.

Company stock plans are an essential component of your employee benefits, offering you a stake in your company’s success. Understanding the different types of equity incentives is key to making informed financial decisions. We will help you understand your individual equity incentive plan so you can make the best decision for your financial future.

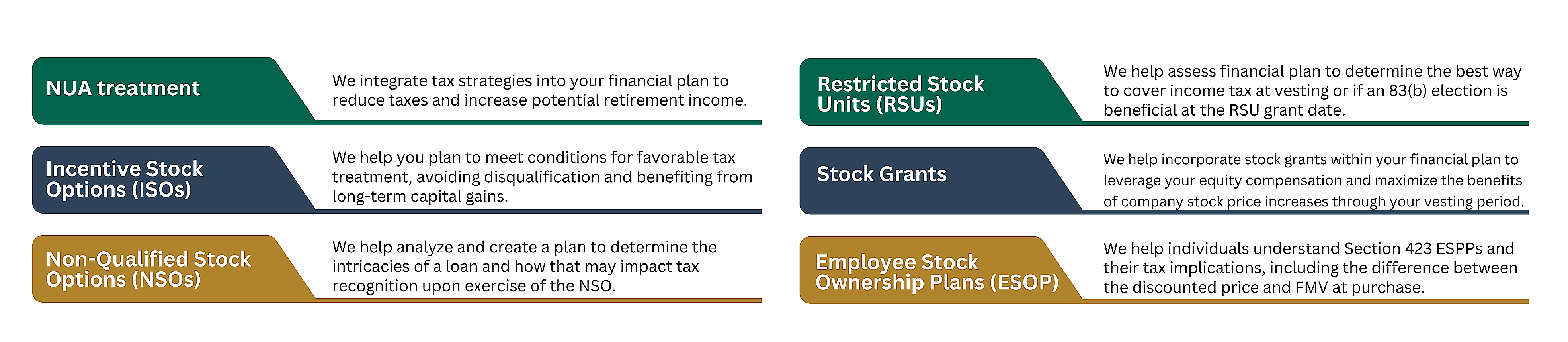

Types of Equity Incentive:

- Net Unrealized Appreciation (NUA)

- Incentive Stock Options (ISOs)

- Non-Qualified Stock Options (NSOs)

- Restricted Stock Units (RSUs)

- Stock Grants

- Employee Stock Ownership Plans (ESOPs)

Our team understands that company stock plans are more than just a part of an employee’s salary—they’re a partnership between employee and employer. We know how company stock plans are an important part of employee benefits and can help you understand the different types of equity compensation.

Our team understands how different employee benefit plans play a role in an employee’s retirement. We help employees understand the intricacies of their plan and determine timelines, tax, and redemption plan strategies to maximize retirement benefits.

Tell us your financial aspirations, and we’ll handle the rest

Our team actively manages your portfolio using tailored strategies that maximize returns and minimize risk — providing you with reports and insights every step of the way.